Ever stared at a loan offer, and the numbers just started swimming in front of your eyes? The interest rate, the term, the principal… it feels like a foreign language. You’re just trying to figure out one simple thing: “Can I actually afford this?”

You’re not alone. Taking out a loan, whether it’s for a new car, a home renovation, or consolidating some pesky credit card debt, can feel like stepping into a financial fog. You know where you want to go, but the path isn’t clear. What if you make a wrong turn and end up paying thousands more than you needed to?

That’s where the fog lifts.

Welcome to your financial GPS. This page isn’t just about a tool; it’s about giving you the clarity and confidence to make brilliant money decisions. Our accurate loan calculator is designed to do more than just crunch numbers. It’s here to show you the complete story of your loan, from the first payment to the final handshake when you’re debt-free.

In this guide, we’ll walk you through everything you need to know. We’ll cover:

- How to use a loan calculator step-by-step (it’s easier than you think!).

- What all the results actually mean in plain, simple English.

- Pro-level strategies to use this knowledge to save a boatload of money on interest.

- A peek behind the curtain at the math that makes it all work.

- And finally, the smart borrowing habits that will set you up for long-term financial success.

So, grab a cup of coffee, and let’s demystify the world of loans together. It’s time to take control.

What is a Loan Calculator and Why Should You Care?

At its heart, a loan calculator is a simple tool that answers a complex question. You tell it three things:

- How much you want to borrow (the loan amount).

- The interest rate the lender is offering (the cost of borrowing).

- How long you have to pay it back (the loan term).

In an instant, it tells you the most important number: your monthly payment. But that’s just the beginning.

Beyond Just Numbers: Your Financial Crystal Ball

Think of a loan calculator as your financial crystal ball. It lets you see into the future and understand the real impact of a loan on your life. Without it, you’re just guessing. With it, you gain superpowers:

- The Power of Clarity: No more surprises. You’ll know exactly how much you’ll pay each month and for how long.

- The Power of Comparison: You can easily compare different loan offers from banks, credit unions, and online lenders to find the absolute best deal.

- The Power of Planning: You can adjust the numbers to see how a different loan amount or term would affect your monthly budget. Can you afford that slightly more expensive car? Let the calculator tell you.

- The Power of Motivation: Seeing the total interest you’ll pay over the life of the loan can be a huge motivator to pay it off faster!

The Cost of Not Using a Loan Calculator

Ignoring this simple tool is one of the easiest financial mistakes you can make. It’s like agreeing to buy a car without ever looking at the price tag. You might end up with a monthly payment that strains your budget, forcing you to cut back on things you love.

Worse, you could be blind to the total cost. A longer loan term might give you a comfortably low monthly payment, but you could end up paying thousands of extra dollars in interest over the years. That’s money that could have been in your pocket, invested for your future, or spent on a well-deserved vacation.

Using a loan calculator takes maybe 30 seconds, and it can save you a fortune in both money and stress. It’s a no-brainer.

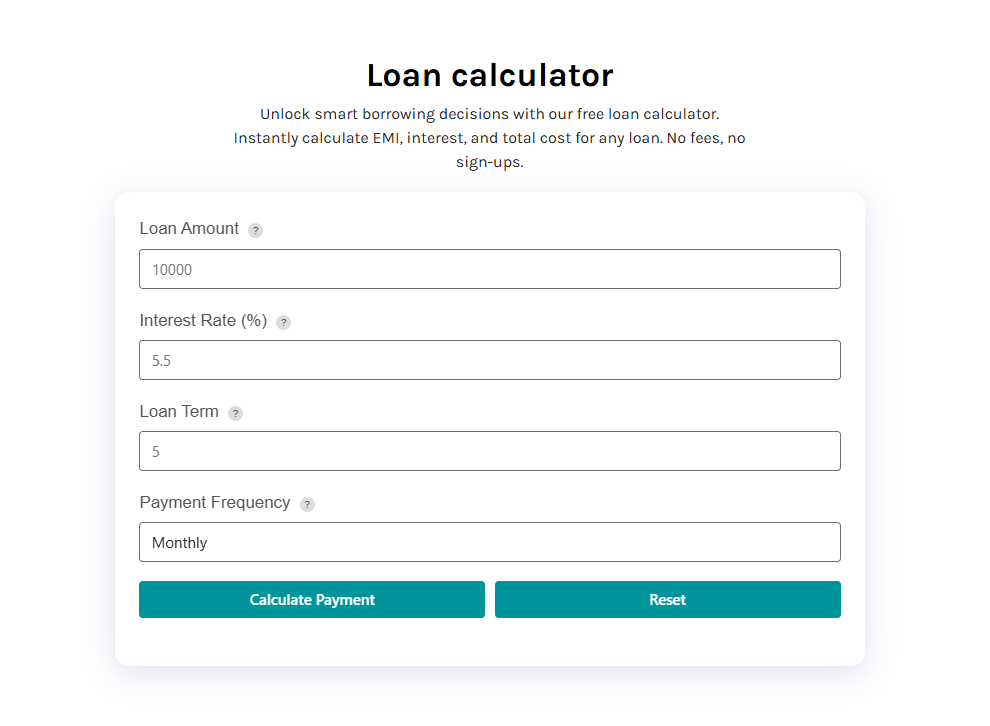

How to Use Our Accurate Loan Calculator (A Simple Step-by-Step Guide)

Ready to see it in action? Our calculator is designed to be intuitive and straightforward. Let’s walk through the three key pieces of information you’ll need to enter.

Step 1: The Loan Amount (How much do you really need?)

This is the total amount of money you’re borrowing from the lender. It’s often called the principal. It might seem obvious, but it’s worth taking a moment to think about this number. If you’re buying a car for $25,000 and have a $5,000 down payment, your loan amount is $20,000.

Pro Tip: Always try to borrow only what you absolutely need. It’s tempting to add a little extra for “cushion,” but remember that every single dollar you borrow is a dollar you have to pay back with interest.

Step 2: The Interest Rate (The Price of Borrowing Money)

The interest rate is essentially the fee the lender charges you for letting you use their money. It’s expressed as a percentage. You’ll usually see this referred to as the Annual Percentage Rate (APR), which includes the interest rate plus some lender fees, giving you a more complete picture of the borrowing cost.

When looking at rates, you’ll encounter two main types:

- Fixed Rate: The interest rate is locked in for the entire life of the loan. Your monthly payment will never change. This is great for budgeting and peace of mind.

- Variable Rate: The interest rate can change over time based on market conditions. It might start lower than a fixed rate, but it could increase later, causing your monthly payment to go up.

For most personal and auto loans, a fixed rate is the safer, more predictable option.

Step 3: The Loan Term (Your Repayment Marathon)

The loan term is the length of time you have to pay back the loan. It’s typically expressed in months or years. Common terms for auto loans are 48, 60, or 72 months (4, 5, or 6 years). Personal loans often have terms between 24 and 60 months (2 to 5 years).

Choosing your term involves a trade-off:

- Shorter Term: Your monthly payments will be higher, but you’ll pay the loan off faster and pay significantly less in total interest.

- Longer Term: Your monthly payments will be lower and more manageable, but you’ll be in debt for longer and pay much more in total interest.

The calculator is the perfect place to see this trade-off in black and white.

Decoding Your Loan Results: What Do These Numbers Actually Mean?

You’ve plugged in the numbers and hit “Calculate.” Now you’re looking at a bunch of results. Let’s break down what they mean for you and your wallet.

Your Monthly Payment (The Big One)

This is the amount you’ll need to pay your lender every month until the loan is paid off. This is the number that needs to fit comfortably within your monthly budget. It’s a combination of two things: a portion that pays down your principal (the money you borrowed) and a portion that pays the interest.

Total Interest Paid (The Eye-Opener)

This number often comes as a shock. This is the total amount of money you will pay on top of the original loan amount over the entire term. It is the lender’s profit and the true cost of your loan.

Let’s say you borrow $20,000 for a car over 5 years at a 7% interest rate. Your monthly payment would be about $396. But your total interest paid would be $3,762! That’s nearly four thousand dollars that could have been used for something else. Seeing this number is what motivates savvy borrowers to find ways to reduce it.

The Amortization Schedule: Your Loan’s Secret Diary

This is where the real magic happens. “Amortization” is just a fancy word for paying off a debt over time in regular installments. The schedule is a detailed, payment-by-payment breakdown of your entire loan journey. It shows you exactly how much of each monthly payment is going toward the principal and how much is going toward interest.

What to Look for in the Schedule

When you first look at an amortization schedule, you’ll notice something interesting:

- Early payments are mostly interest. In the beginning, a huge chunk of your payment is just covering the interest cost. Only a small amount is actually reducing your loan balance.

- Later payments chip away at the principal. As you continue to make payments, the balance slowly shrinks. Because the interest is calculated on a smaller balance, the interest portion of your payment gets smaller each month, and the principal portion gets bigger.

- The “Tipping Point.” Eventually, you’ll reach a point where more of your payment is going toward the principal than the interest. This is a great milestone to see!

Sample Amortization Table

To make this crystal clear, let’s look at a simplified amortization schedule for a $10,000 loan at 8% APR for 3 years (36 months). The monthly payment would be $313.36.

| Payment # | Beginning Balance | Monthly Payment | Principal Paid | Interest Paid | Ending Balance |

| 1 | $10,000.00 | $313.36 | $246.70 | $66.66 | $9,753.30 |

| 2 | $9,753.30 | $313.36 | $248.34 | $65.02 | $9,504.96 |

| 3 | $9,504.96 | $313.36 | $249.99 | $63.37 | $9,254.97 |

| … | … | … | … | … | … |

| 18 | $5,247.92 | $313.36 | $278.38 | $34.98 | $4,969.54 |

| … | … | … | … | … | … |

| 34 | $926.88 | $313.36 | $307.18 | $6.18 | $619.70 |

| 35 | $619.70 | $313.36 | $309.23 | $4.13 | $310.47 |

| 36 | $310.47 | $313.36 | $310.47 | $2.89 | $0.00 |

See how in Payment #1, you paid nearly $67 in interest? But by Payment #35, the interest was only about $4. This table visualizes your path to becoming debt-free.

Pro-Level Strategies: Using a Loan Calculator to Save Money

Okay, you understand the basics. Now let’s use the calculator as a strategic weapon to keep more money in your pocket.

The Power of Extra Payments

This is the single most effective way to destroy debt faster. Even small extra payments can have a massive impact because 100% of that extra money goes directly toward the principal balance. This reduces your balance faster, which means you pay less interest in the next payment, and the effect snowballs from there.

Try this: Go to the calculator and find a field for “Extra Monthly Payment.” Using our $10,000 loan example from above, what happens if you add just $25 extra per month?

- You’d pay off the loan 3 months earlier.

- You’d save $145 in interest.

It might not sound like a lot, but that’s a nice dinner out or a new pair of shoes, just for paying a little extra. What if you paid an extra $100 per month? You’d pay it off a full year early and save over $500 in interest! Play with the numbers and see what’s possible for you.

Comparing Loan Offers Like a Boss

Never take the first loan offer you get. Lenders are competing for your business. Let’s say you get two offers for a $15,000 loan:

- Offer A: 6% APR for 60 months (5 years)

- Offer B: 7% APR for 48 months (4 years)

At first glance, Offer A’s lower interest rate looks tempting. But let’s plug them into the calculator:

- Offer A: Monthly payment of $290, total interest of $2,397.

- Offer B: Monthly payment of $359, total interest of $2,246.

Even though Offer B has a higher interest rate and a higher monthly payment, you would actually save about $150 in total interest and be debt-free a full year sooner! The calculator makes this decision easy by focusing on the total cost, not just the monthly payment.

The Math Behind the Magic (For the Curious Minds)

Ever wonder how the calculator comes up with your monthly payment so quickly? It’s not magic; it’s a well-established mathematical formula. You absolutely don’t need to know this to use the calculator, but for those who are curious, here’s a peek behind the curtain.

The Loan Payment Formula (PMT)

The standard formula for calculating the monthly payment (M) on an amortizing loan is:

$$M = P \frac{i(1 + i)^n}{(1 + i)^n – 1}$$

What Do the Letters Mean?

- $M$ = Your total monthly payment.

- $P$ = The principal loan amount (how much you borrowed).

- $i$ = Your monthly interest rate. The calculator gets this by taking your annual rate (like 8%) and dividing it by 12 (so, 0.08 / 12 = 0.00667).

- $n$ = The total number of payments over the loan’s lifetime. For a 3-year loan, this would be 3 * 12 = 36 payments.

See? It’s a bit complex, which is precisely why having a calculator do the heavy lifting in a fraction of a second is so wonderful. It frees you up to focus on what the numbers mean for your life, not on the complex math itself.

Beyond the Calculator: Smart Borrowing Habits

A loan calculator is an incredible tool, but it’s just one piece of the puzzle. To truly build a healthy financial future, combine its power with these smart borrowing habits.

- Know Your Credit Score: Before you even apply for a loan, check your credit score. A higher score qualifies you for lower interest rates, which can save you thousands.

- Shop Around: Don’t just go to your primary bank. Get quotes from at least three different lenders, including local credit unions and reputable online lenders. Let them compete for you.

- Read the Fine Print: Look out for hidden costs like origination fees, application fees, or prepayment penalties (a fee for paying the loan off early).

- Budget First, Borrow Second: Never take out a loan without knowing exactly how the payment will fit into your monthly budget. If it’s too tight, you need a smaller loan or a cheaper alternative.

Take Control of Your Financial Future Today

A loan doesn’t have to be a source of stress or confusion. With the right tool and a little bit of knowledge, you can navigate the borrowing process with total confidence. A loan calculator transforms you from a passive passenger into an empowered driver of your own financial journey.

It gives you the vision to see the road ahead, the power to compare different paths, and the strategy to reach your destination faster and with more money in your bank account.

Ready to lift the fog? Scroll up and use our accurate loan calculator now. Play with the numbers, explore your options, and see for yourself just how clear your financial future can be.

Frequently Asked Questions (FAQ)

1. What is the best loan calculator?

The best loan calculator is one that is accurate, easy to use, and provides all the key information you need to make an informed decision. Look for a calculator that shows not only the monthly payment but also the total interest paid and a full amortization schedule. This allows you to see the true cost of the loan and understand how your payments are broken down over time.

2. How do I calculate my monthly loan payment manually?

You can calculate your monthly loan payment using the standard PMT formula: $M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1 ]$. To do this, you need the principal (P), the monthly interest rate (i), and the total number of payments (n). However, the math can be complex and prone to errors. Using a reliable online loan calculator is a much faster and more accurate way to determine your monthly payment without having to do the complex calculations yourself.

3. Does paying extra on a loan really help?

Absolutely! Paying extra on a loan is one of the most effective ways to save money. Since 100% of any extra payment goes directly to your principal balance, you reduce the amount of interest that accrues in the future. This “snowball” effect allows you to pay off your loan faster and can save you hundreds or even thousands of dollars in total interest over the life of the loan.

4. What is APR and how does it affect my loan?

APR stands for Annual Percentage Rate. It represents the total annual cost of borrowing money and includes not only the interest rate but also most lender fees and other charges associated with the loan. APR gives you a more complete, “apples-to-apples” way to compare loan offers from different lenders. A lower APR means a less expensive loan, so it’s one of the most important numbers to look for when shopping for financing.

5. Can I use a simple loan calculator for a mortgage?

While you can use a simple loan calculator to get a basic estimate of a mortgage’s principal and interest (P&I) payment, it’s not ideal. Mortgage payments are typically more complex and include additional costs like property taxes, homeowners insurance, and sometimes private mortgage insurance (PMI). For an accurate mortgage calculation, it’s best to use a dedicated mortgage calculator that allows you to input these additional factors for a true picture of your total monthly housing payment.